I recently watched a thought-provoking video on Nairametrics TV titled “Where to Invest in Nigeria in 2025!”. The video highlighted seven key asset classes for smart investors. In true 9jaCashFlow style, here’s a breakdown of their suggestions, along with our own thoughts and opinions.

1. Equities (Nigerian and US Stocks)

Nigerian stocks have performed impressively in recent years, and the trend may continue. However, patience is key—wait for good buying levels. Unfortunately, the Nigerian Stock Exchange (NSE) Index isn’t readily available on TradingView. You can find the line chart on Trading Economics or Ngxgroup.

Our picks: Popular stocks like Dangote Cement and GTBank could be worth analyzing for good entry points.

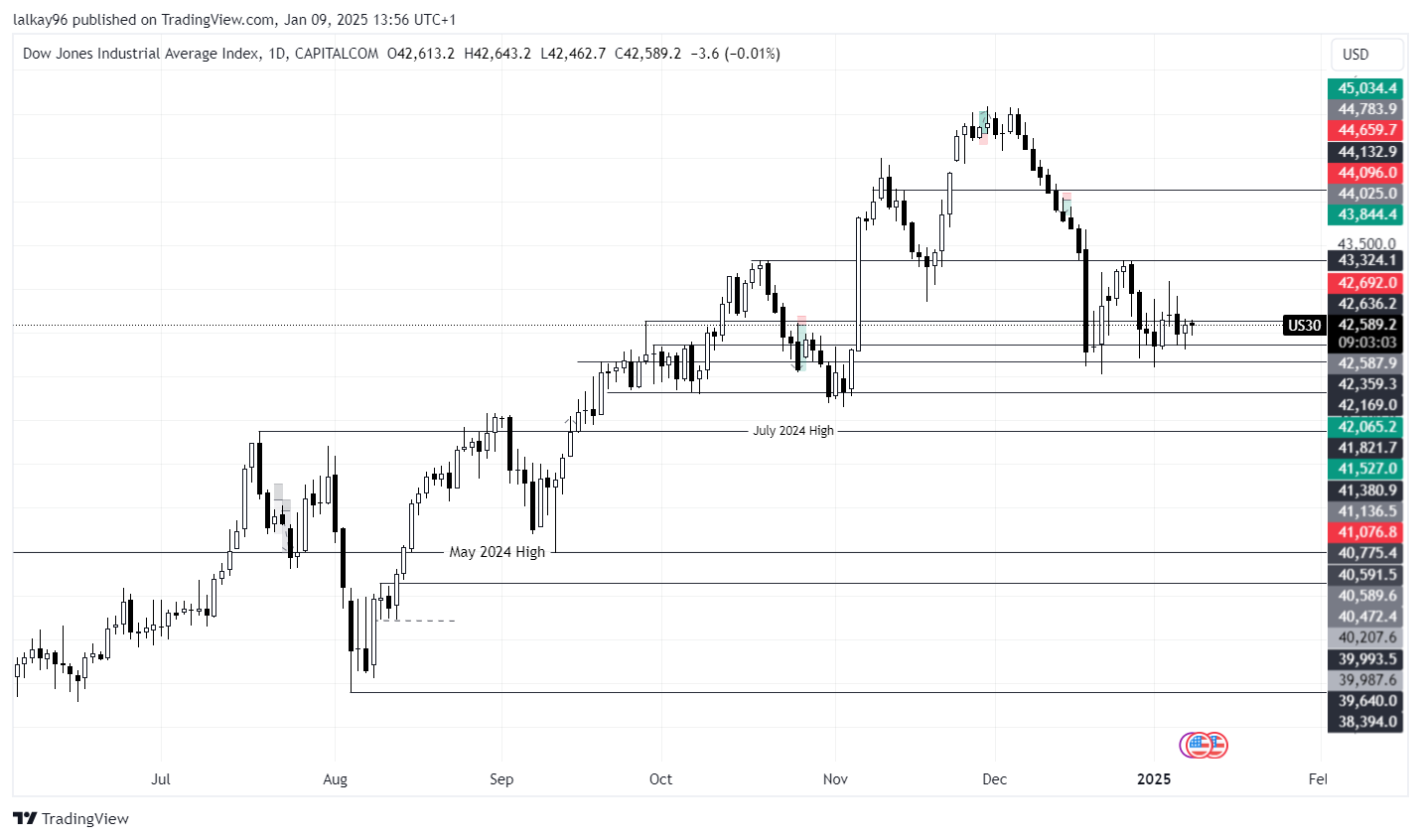

For US stocks, we believe major players like Tesla, Amazon, PayPal, Shopify, and Disney are in the overbought zone. Patience is crucial—wait for these stocks and indices like Nasdaq (US100), Dow Jones (US30), and S&P500 to hit oversold levels for better entry opportunities.

Top US Indices Chart

2. Forex Deposits and Savings

Protecting your savings from naira devaluation is smart. At 9jaCashFlow, we recommend holding dollars, given the consistent rise in the dollar index. It’s one of the safest currencies for savings in today’s global economy.

3. Forex-Denominated Investments

While forex-denominated investments are promising, we don’t have extensive experience in this area. For now, we’ll skip giving specific recommendations.

4. FGN Bonds

FGN bonds can provide nearly guaranteed returns, and platforms like Bamboo and Rise make it easy to invest. However, we’re cautious. Despite Nairametrics’ optimism about Nigeria’s ability to meet its debt obligations, 9jaCashFlow is skeptical about tying up funds in this avenue.

5. Real Estate

Real estate remains a solid asset class, but diversification is key. Avoid being overly exposed to Nigerian real estate due to naira devaluation. Focus on cashflow properties in major cities and commercial hubs that offer consistent rent income.

Pro tip: Work with trusted experts to avoid scams, but ensure their deals aren’t overpriced or inflated.

6. Mutual Funds

While Nairametrics suggests mutual funds, we at 9jaCashFlow aren’t fans of actively managed funds. Why? After subtracting management fees, the returns often don’t outpace inflation. We recommend exploring other options for better growth potential.

7. Cryptocurrency

This is one of our core areas of expertise at 9jaCashFlow. We strongly believe crypto will continue to outperform other asset classes in the long term.

Current trends:

- Crypto AI agents

- Layer 1 coins

- Memecoins

However, success in crypto requires understanding market cycles and identifying high-potential altcoins early. Knowledge is your best weapon in navigating this dynamic space.

Final Thoughts

We noticed Nairametrics TV didn’t say anything about technology and agriculture investment. We believe they might have completely ignored it or it’s a topic for another day.

Nevertheless, here’s a quick summary of our 9jaCashFlow opinions:

- Equities: This is a great option if you time your entry right.

- Forex Deposits: Hold dollars for stability.

- Forex-Denominated Investments: Promising but not our area of expertise yet.

- FGN Bonds: Safe but not our first recommendation.

- Real Estate: Excellent for cashflow properties in major cities.

- Mutual Funds: Not worth it due to low net returns.

- Cryptocurrency: High growth potential, but requires expertise. We will choose bitcoin and major altcoins (join the 9jacashflow inner circle to know more).

What do you think? Share your thoughts in the comments below!

P.S. Join the 9jaCashFlow Telegram group for more market updates and opportunities. Stay ahead of the game! 🚀