Trading can be one of the most rewarding skills if you understand what you’re doing and stay disciplined. On the flip side, it can be devastating if approached recklessly.

Here’s a list of my 15 best trading tips in 2025, along with some personal experiences to drive the points home.

1. Trading is a Marathon, Not a Sprint

Trading is a skill that takes time to master. It requires dedication to learning strategy, psychology, risk management, position sizing, and understanding market cycles.

Don’t expect to make significant income in six months or even a year. Ironically, the more you focus on the money, the harder trading becomes. Instead, focus on building a strong process and system.

As Alexander Elder wisely said:

“Your primary goal as a trader is to take good trades. Money is secondary. Money follows good trades.”

2. There Are No Shortcuts or Holy Grails

Beware of trading gurus who claim to have a secret strategy or 100% accurate signals—they don’t exist.

A method might work for now, but is it sustainable? Is it profitable long-term? Always balance technical and fundamental analysis with proper risk management.

Falling for marketing gimmicks only elongates your journey to profitability.

3. Trading is Not an ATM

Unlike withdrawing money from an ATM, there’s no guarantee you’ll make money from the market today or tomorrow.

Losses are part of trading, and the goal is to win more than you lose. If you crave certainty, consider a steady job or business instead.

4. Less is More

Over time, you’ll realize that simplicity often beats complexity in trading.

- Swing and position trading generally outperform day trading or scalping.

- Passively managed funds tend to yield better results than actively managed ones.

Focus on quality, not quantity.

5. Capital Allocation

Benjamin Graham’s “The Intelligent Investor” suggests allocating:

- 30% to active trading

- 70% to long-term investing

If you’re still learning or struggling, start smaller—dedicate 10% or less to active trading and leave the rest in safer investments. The market can be volatile and brutal in the short term.

6. Risk Management is Non-Negotiable

Most of trading is about managing risk. No trade is ever guaranteed, so always control your downside:

- Risk 1% per trade as a general rule.

- Risk 2% only for high-probability setups.

- Avoid risking more than 2%—it creates randomness and unnecessary volatility in your equity curve.

The market is humbling. The moment you feel invincible, it’ll remind you to stay grounded.

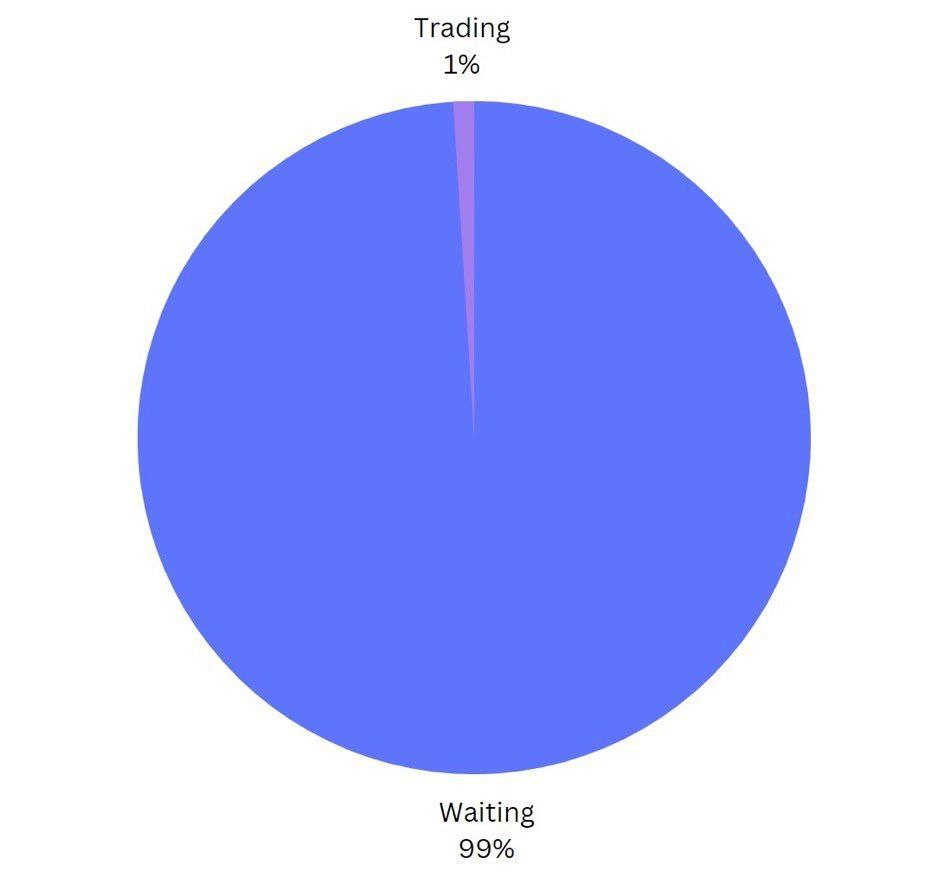

7. Patience is Your Superpower

Patience pays in trading. Waiting for the right entry, for candlestick confirmation, and for the trade to play out is key.

Don’t rush the process—timing is everything.

8. Master Backtesting and Forward Testing

A good strategy today doesn’t guarantee profitability in the future. Use tools like TradingView’s Pine Script to backtest your approach over years of data.

If a strategy isn’t consistently profitable, it’s time to tweak it or move on.

9. Avoid Trading Other People’s Money

If you’re a beginner, steer clear of trading with other people’s money. The emotional pressure can derail your progress and lead to debt if you lose their funds.

Even experienced traders should be cautious. Use prop firm accounts or funded accounts and charge a commission on profits instead of handling direct investments.

I learned this the hard way—managing someone else’s account went well at first, but it backfired when the stakes got higher. It caused issues that took years to resolve.

10. Be Transparent if Offering Signals

If you offer a signal service, always emphasize that no strategy is 100% accurate. Encourage subscribers to practice proper position sizing and risk management.

Remind them consistently—failure to do so can lead to misunderstandings and unnecessary blame.

11. Don’t Let Social Media Pressure You

Comparing yourself to flashy trading influencers on social media can ruin your focus and discipline.

Remember, most “overnight successes” took years of grinding. Focus on your journey, not someone else’s highlight reel.

12. Get a Mentor or Accountability Partner

A mentor can significantly shorten your learning curve. They’ll help you avoid pitfalls and refine your approach.

Choose someone who practices what they preach and can hold you accountable. Remember, mentorship isn’t free—invest in the relationship by paying for their time, sending gifts, or sharing updates.

13. Don’t Quit Your Job Prematurely

After some early trading success, I made the mistake of quitting everything to trade full-time. This put immense pressure on me to succeed, leading to overtrading and forcing trades.

Keep your job, studies, or business until you have 1–2 years of living expenses saved outside of your trading income.

14. Follow the Trend

Trading with the trend simplifies decision-making:

- Buy when the market trend is bullish.

- Sell when the market trend is bearish.

Counter-trend trading can work but often requires faster profit-taking to avoid losses.

15. Adapt to the Market

Markets change constantly. What worked last year may not work this year. Stay flexible and adjust to new trends and opportunities.

If you’re wrong, cut your losses quickly. Adaptability also means knowing when to take profits and step back.

Final Thoughts

The market won’t always go your way, but these tips can help you navigate it more confidently.

At 9jaCashFlow, we’re committed to sharing lessons from our experiences—both mistakes and successes—to help you trade smarter.

Keep learning, stay disciplined, and trade wisely.

What do you think? Let’s discuss this in the comments!

Further Reading:

- What Is the Best Type of Trading? Scalping, Swing, or Position Trading?

- The Key to Profitable Trading in 2025

Join our Telegram Channel for more daily market insights and exclusive trading tips.

Discover more from 9jacashflow.com

Subscribe to get the latest posts sent to your email.