Investing in your future is one of the most important things you can do in life. Simply put, it is the process of making your money work for you(i.e. you turn your capital into your employee), and the only reason why you should not be an investor is if you don’t like to make more money or create additional sources of income. Truth be told, you’ve got to start early because investing is not a get-rich-quick scheme. You need to have a long-term mindset. I will also be the first to tell you that the game of investing can be fun and interesting when you’re making money, and it can also be frustrating if you’re not making a dine. So in this article, I will be showing you nine(9) of the early mistakes I made as an investor so that you can avoid them and at the same time become a better investor.

9 Mistakes I Made In My Early Investment Stage

Mistake 1: Not having a well-written and clearly stated goal

This perhaps the single mistake made by all the newbies in the investing world. Most don’t have a well written and documented goal. All they want to do is make money 💰, but I will tell you from experience that making money is not a good goal. And without a solid goal; you can make a lot of money, get carried away by shining objects, and lose everything you made within a matter of days.

So what’s a good goal?

A good goal start with you knowing yourself and understanding your current financial situation. After evaluating myself, my goal might be to achieve financial freedom in 5 years or to raise my current portfolio to $50,000 in 2 years. That’s Kehinde Lawal’s goal and you shouldn’t copy it because we’re different and it might not necessarily work for you.

Also, your goal will determine the strategy you will employ in your investing. This is how you invest, what you invest in, and how long you will be in an investment. I will like to suggest that your goal should not be hard in any way. It should be as simple as possible.

You need to also know your tolerance for risk. I like a more risky and high-yield investment. Conversely, if you have a low tolerance to risk and you have huge savings, a sample goal for you might be to earn 10% on your capital every year over five years, through investment in treasury bills. Again, that’s you.

Mistake 2: Not focusing

The mistake of not focusing is major as a result of not having a clear goal. Once you have a clear and well-written goal then you would know what to focus on.

You see, as a beginner investor, there are numerous investment vehicle/asset class you can put your money into. We have Stocks, Bonds, Cryptocurrency, Foreign Exchange(FOREX), Real Estate, Real Estate Investment Trusts(REITs), Commodities etc. It’s always advisable that at first, it’s good to focus on just one. When you now understand the nitty-gritty, and you’re profitable you can now move to others.

Again, do not make the mistake of trying all these investment options at ones. You might end up losing more than you can afford to lose. It happened to me, I had lost all my money when I switched from Forex to Crypto before I realised that this is different games and playing fields. Even if you choose Cryptocurrency, you can further streamline your portfolio to the first 100 crypto or the ones with large market capitalization. If you trade commodities you can start by only trading Gold and Silver. It’s simple but hard to do if you can’t ignore the shining object and focus on your underlining asset.

Mistake 3: Poor position sizing

I will be the first to agree that it takes discipline before you can master position sizing. Position size is how big or how small you bet. Wrong or poor position sizing simply means you’re placing more money on a bet than you can afford to lose and relative to your account balance.

Let me ask you a question. If you have #100,000 and you’re to bet on the outcome of a football match that you’re uncertain about the outcome. Will you put all the 100,000 in a single bet?

I’m sure you would not, but if you try it that’s wrong position sizing. It means if you lose that bet you’re packing your backs and going home. And that’s what every trader try to avoid. Losing all their capital and not being able to make any more trades.

Even if you place a bet with half of your total balance 😉 it’s still poor Position sizing. It means that you will no longer be in the game if you’re wrong 2 consecutive games in a role. Which is very possible.

So what’s the best position sizing technique?

Although some people advise you split your capital into 4, that is you don’t use more than 25% of your capital on a single trade, I think using 25% as risk capital is for experts. The proper position sizing technique is to not use more than 1% as your risk capital especially if you’re trading. That way you would still be in the game even if you lose 280 bets in a roll, which is often not possible.

Mistake 4: Poor Trade Management

Even after some people have set out a clear and we’ll written goal, they still don’t know how to manage their trade and investment well from entry to exit. You will see a lot of people exiting a trade with little profit even when there’s still potential for upward growth or more profit. You also see people closing a well-taken trade/investment just because it went against them a little.

Part of poor trade management is scalping the market when you’re a swing trader or long term position trader. Some people even spend all their time on the PC watching the charts. This poor trade management technique can lead to health issues. To manage your trade you only need common sense, Stop Loss, and checking the status of your trade like twice in a day if you’re a long-term trader.

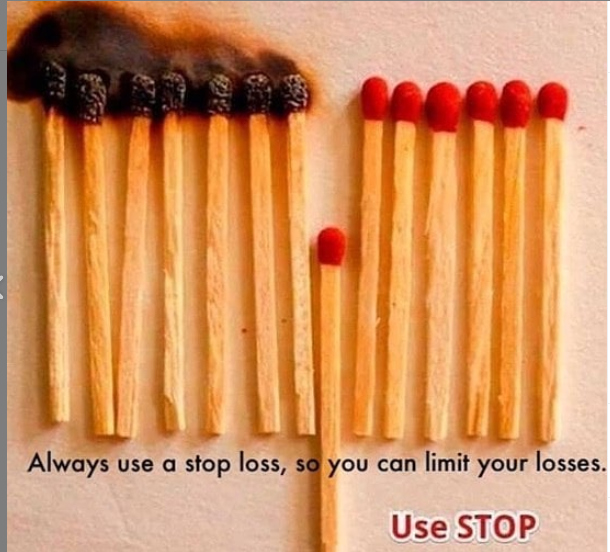

Mistake 5: Not using Stop Loss

Most traders are guilty of this mistake many times due to overconfidence 😂. You see, when they start making big money, they now think they’re an expert. They now start placing a trade without stop loss believing they can’t go wrong.

You see, a Stop Loss is like a fire extinguisher, you only know it’s important when things start burning. And in other to avoid large burnt or large losses, you just have to use the fire extinguishers.

Never make the mistake of not using a stop loss. You see there are only 4 outcomes in trading.

- Big win,

- small win,

- small loss, and;

- big loss

If you can avoid number 4 (big loss) in the first place, you will always be in the game. What a stop Loss does is to help you remove big loss, so use it.

Mistake 6: Not dollar-cost averaging

This a very simple technique. You see, the same way you shouldn’t test the depth of a river with both feet, you should not also buy a commodity or go into an investment with all your money thinking that it’s right time for it to go up or invest.

Instead, what you do when you see a commodity that the price is so low and you think it will go up is to buy gradually, and that’s called dollar-cost averaging. When you buy with little capital at first, you keep buying as the price continues to fall. And if the price didn’t fall, you also buy as it keeps rising. Using this method helps you average you cost, potential loss and potential profit.

Your final average price is the total value of what you bought divided by the total quantity you bought.

Mistake 7: Not being realistic or trying to force profit out of the market.

This very common among new traders and investor. Let say the market is in a correction or bear market, and prices start falling. Some newbie traders might decide to buy at that moment, just to risk it and make little profit on the retracement. That’s quite horrible and can be very expensive. It’s like killing an ant with a hammer. You risk too much just to force little profit out of the market, and if things don’t go as you plan, you lose big.

Mistake 8: Not paying your debt or borrowing at high interest to invest

You see, one thing I did and later realised was very wrong was not paying off my debt, and also borrowing money at a high-interest rate to invest.

I don’t need to explain to you that most times when you owe people money, your mind will not always be at rest. And if you carry that state of mind to trading and investing, you will make every other mistake highlighted in this article.

Another silly mistake is borrowing money at a high interest of about 25% and using it to trade or invest. That’s stupidity and I have done it. I borrowed money from branch app to invest in a market that there are no guaranteed returns in a short time. Because I had to pay branch back the money + interest after a month. I over-leverage and lost all the money. If you have debt first pay them off and trade with the rest of the cash you have, even if it’s little.

Mistake 9: Patience

The main purpose of trading and investing is to grow money and not to make money. Therefore, you must have a long-term perspective and mindset if you want to be successful and be in the game.

Let me tell you this, you can hardly make money day trading Forex, Stocks, Crypto etc. This is mainly because of robot/algometric trading. They have taken short-term opportunities from the market and you can only make tangible money if you are holding trades for a couple of weeks or even months. If you think I’m lying, do prove me wrong.

Bonus Mistakes: Over leveraging, Overtrading, and Under Capitalization

I grouped this because if you’re able to avoid the first set of mistakes I highlighted above, then you will avoid this final set of mistakes.

Over leveraging simply means you’re borrowing money in other to increase your position size. It’s a double-edged sword and it’s always a bitter experience if things don’t go as planned.

Overtrading simply means you have decided to ignore the necessary research stage that’s needed to validate best trades and you now make any trade you feel like trading. I think this a zero-sum game because you will lose money in the end. Funny enough, computers even does it better than you. They can search for trades based on preconfigured settings and they can even execute many trades that you can think off within the shortest time.

Under Capitalization simply means you have very little capital to trade and as a result, you’re trying to force money out of the market through bad position sizing or over-leveraging.

In Conclusion

Trading and investing can be a very interesting game if you can avoid big losses. Nevertheless, mistakes are unavoidable and can be very costly if you don’t have proper risk management. You should try to ensure that you have a clear and well-written goal that shapes your strategy. You should also ensure you employ proper position sizing without leveraging too much or forcing profit of the market. Do not over trade, and have patience.

Trading and investing is a long-term game, which means consistency matters a lot over short-term profit. There’s no point winning big at first and losing everything in the end. You can’t win if you blow up your account in few trades and you’re out of the market. Follow the above rules and thank me later.

Have any questions, don’t hesitate to use the comments below.

Always to your financial success.