The markets have been on a wild ride since October 2024, driven by the strengthening USD index. As traders and investors, understanding how these trends play out across different asset classes is crucial. Here’s a breakdown of the market moves we’ve seen so far.

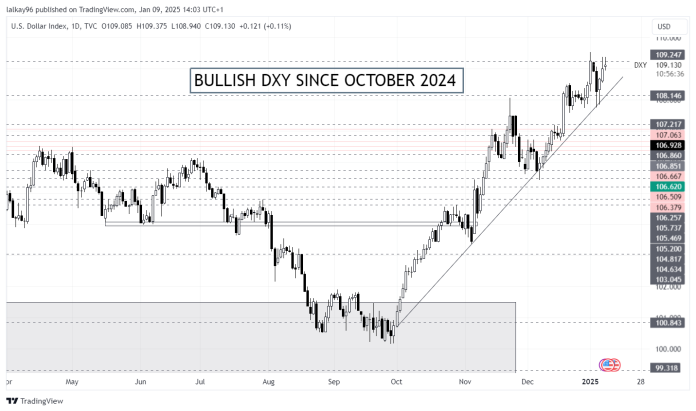

October 2024: USD Index Turns Bullish

In early October, the USD index began to strengthen, sending shockwaves across markets. Competing fiat currencies like the Euro (EUR) and British Pound (GBP) were the first to feel the pressure. Both turned bearish, and we watched as they steadily lost ground against the mighty dollar.

Late October: Commodities Join the Slide

By the end of October, the dollar’s strength started weighing heavily on commodities like Gold and Silver. These safe-haven assets turned bearish as investors favored the dollar over metals, causing a significant pullback in prices.

December 2024: Altcoins Start Bleeding

In the crypto space, altcoins—especially the lagging ones—hit their peaks in early December. But the celebration didn’t last long. A steady bleed began as market sentiment shifted, and weaker projects struggled to maintain momentum.

Mid-December 2024: Bitcoin and Leading Cryptos Follow

The crypto market leaders, Bitcoin (BTC), Ethereum (ETH), etc. peaked in mid-december. However, their rally also came to an end, and they started leading the bearish trend. This shift marked a turning point for many investors who had hoped for a prolonged bull run.

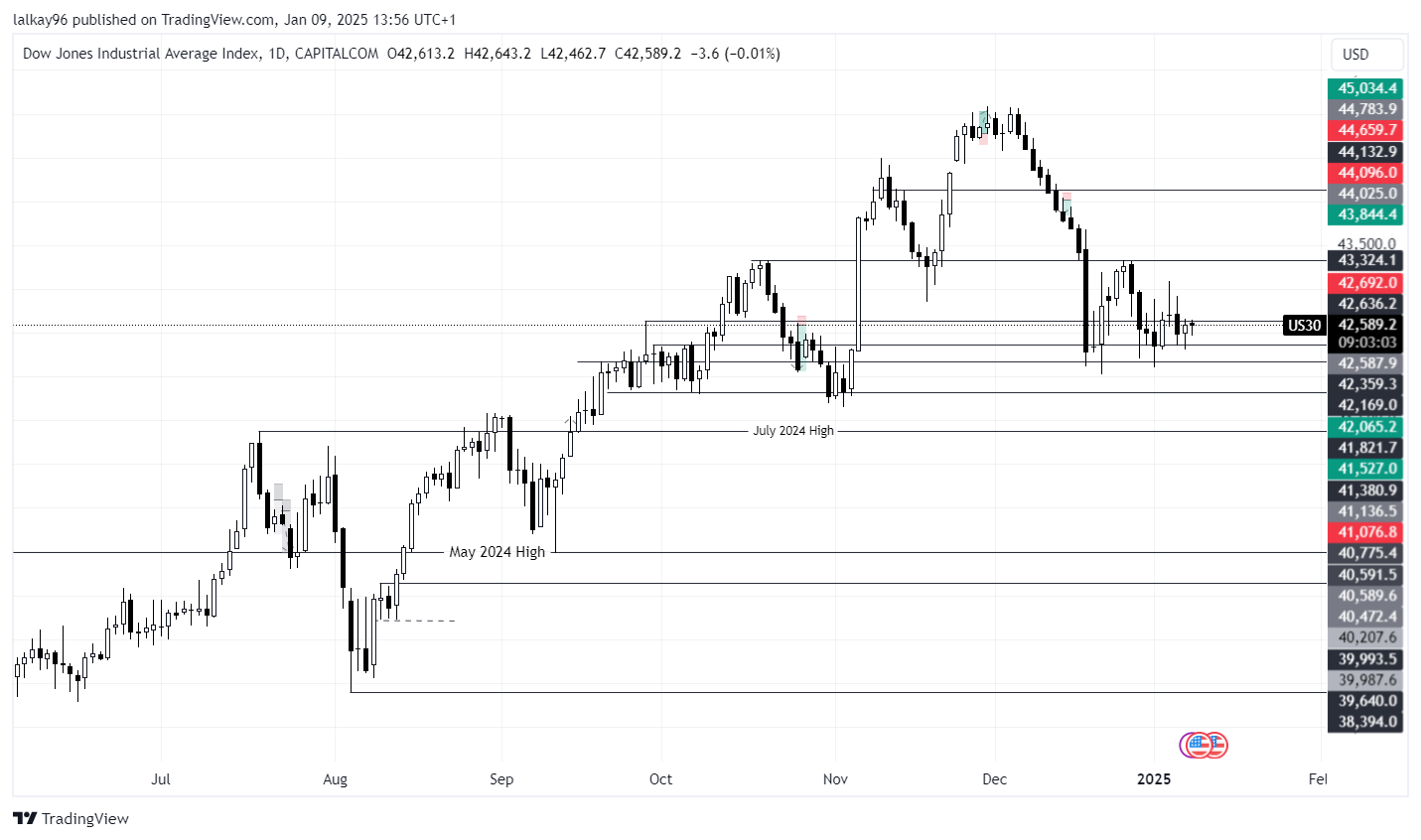

US Indices Drop After December Peaks

In the stock market, US30 (Dow Jones) and US100 (Nasdaq) followed a similar pattern. Both peaked by mid-December 2024 before entering a downward trend that has continued into the new year.

What’s Next?

As we step further into 2025, the big question is:

- What should we expect this month?

- What about the rest of the year?

The markets are clearly moving in response to macroeconomic shifts, and staying informed is key.

Now it’s over to you:

What do you think is next for the markets? Drop your thoughts in the comments—I’d love to hear your perspective.

Let’s keep learning and growing together!

Want more insights like this? Explore our resources on trading, investing, and building wealth at 9jacashflow.com. and don’t forget to subscribe to our Telegram Channel.

Discover more from 9jacashflow.com

Subscribe to get the latest posts sent to your email.