Bitcoin Cash(BCH) is the most renowned Bitcoin hard fork(a second or completely new copy of bitcoin gotten from a chain split).

BCH focuses on becoming peer-to-peer digital cash for daily transactions, instead of just a store of value, like the classic Bitcoin(BTC).

If you want to know more about the major differences between Bitcoin and Bitcoin Cash, you can check this outstanding article from Binance Academy.

So why I’m I buying Bitcoin Cash?

To begin with, it has a limited supply

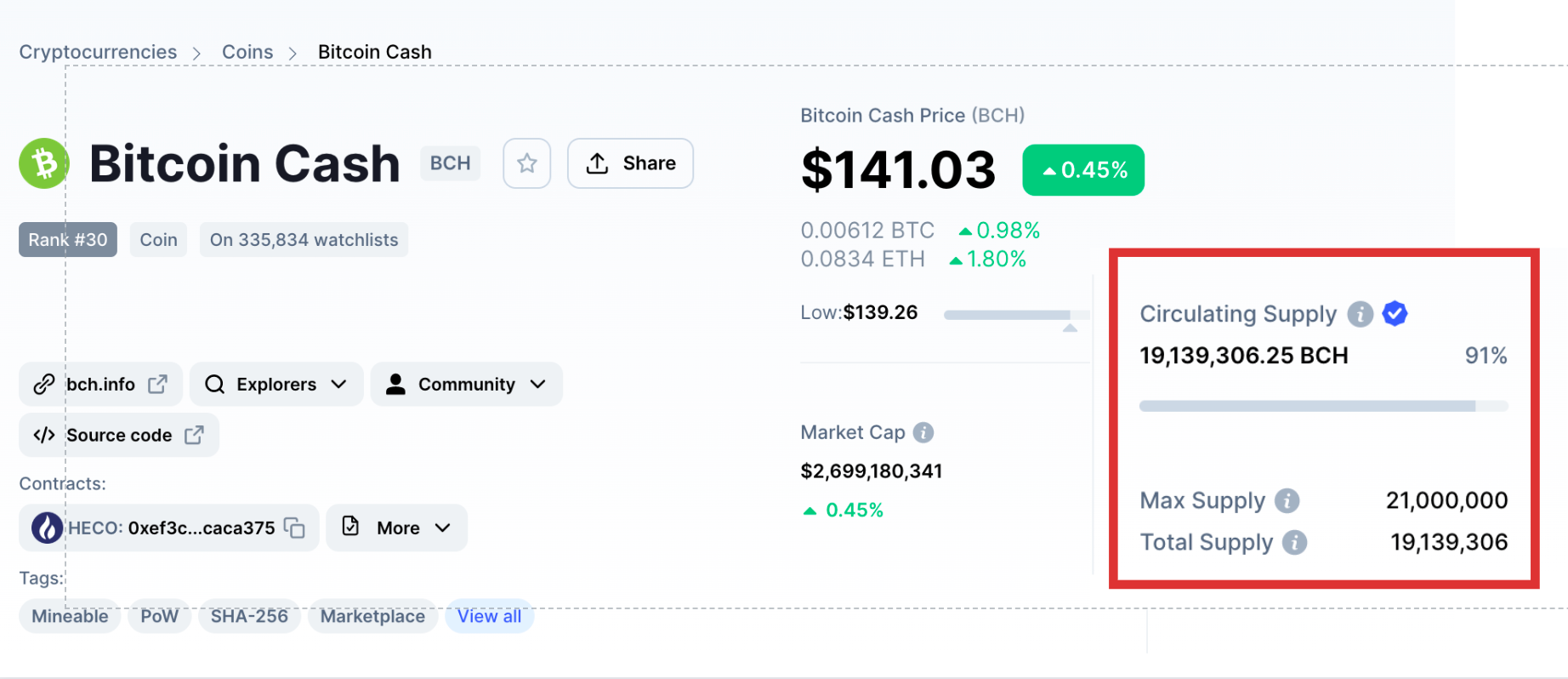

The total supply of Bitcoin cash is capped at 21 million BCH, just like our classical Bitcoin. You can confirm this by viewing the BCH data page on Coinmarketcap.com – which is a popular crypto data aggregator.

The current circulatory supply(available to trade in the market) is 19,138,925.00 BCH, while the total supply that would ever be available is 21,000,000BCH.

The data above depicts scarcity which is a very important attribute of money.

I know you would want to compare BCH with other crypto altcoins but before you do that, you must understand that BCH didn’t have any premine or coins given to the team or developers at launch. This is the highest level of scarcity because to get such coins without premine, you need to: either buy them with your cash or earn them through mining.

It has one of the cheapest fees of any proof of work blockchain

Cheap fees are very important if we’re going to see widespread and global adoption of cryptocurrency.

If you’re rich, you can afford to pay $36 worth of Ethereum or $24 worth of Bitcoin as transaction fees at their recent peak of $4800 and $64,000 respectively. However, not everyone can afford this, especially in 3rd world countries like Nigeria where such an amount for transaction fees is equivalent to the monthly salaries of some individuals.

I know some of you reading this article might not have any feelings for the poor, but at the same time, does it mean Bitcoin and Ethereum are moving toward becoming the cryptocurrency of the rich?

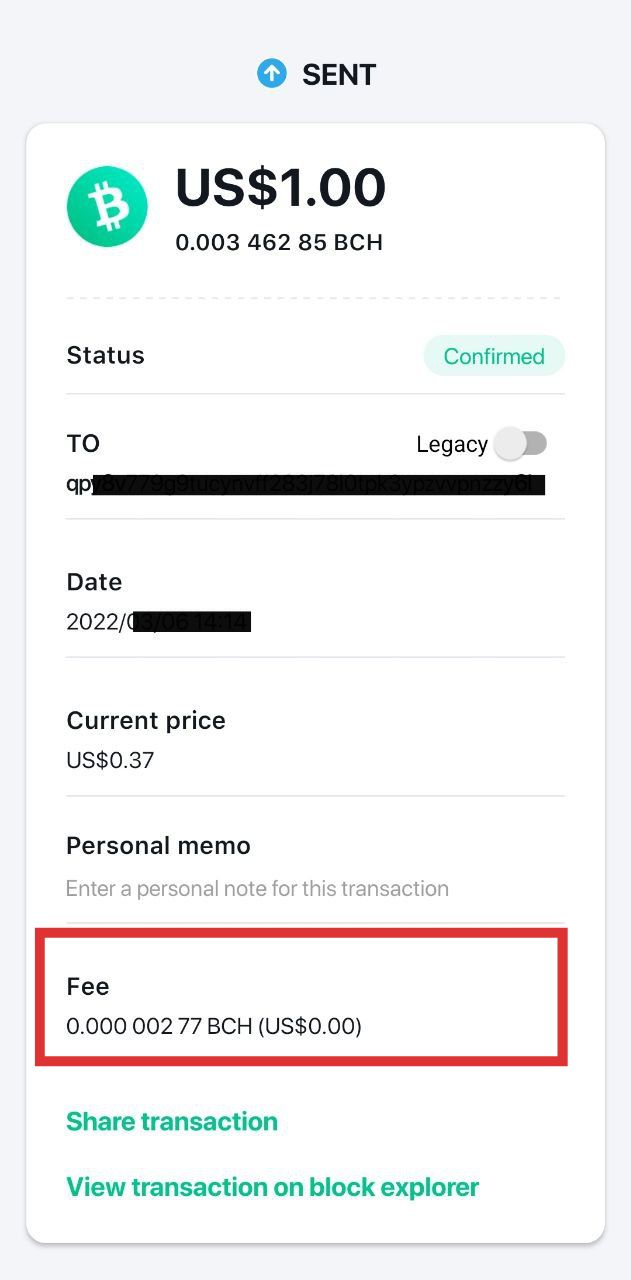

Anyways, how did Bitcoin cash come into the picture? It’s simple. It allows you to send transactions for as cheap as $0.01.

If you think this is a lie, you can try sending a transaction right now from your BCH self-hosted wallet and check the fees.

Below is a copy of one of my transactions.

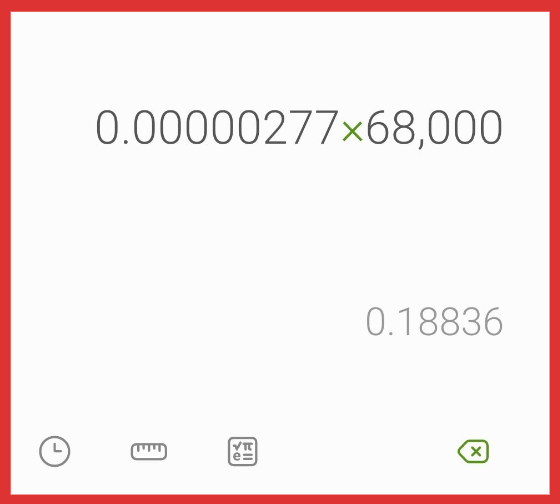

Also, if you look at the fees I paid above, even if BCH gets to the $68,000 price peak of Bitcoin. The fees would still amount to as low as $0.18.

Moreover, I recently spoke with George Donelly, who is a BCH proponent. I asked him whether the BCH devs are committed to ensuring BCH continues to have low fees, and he replied yes. So let’s hope its fees will continue to be relatively low.

The only counter to my argument of the need for cheap fees for the mainstream adoption of crypto is if people – merchants and buyers – start using cryptocurrency platforms like Binance.com as a payment network. It’s zero fees but at the same time centralized. I believe this technique has many adoption use cases already which makes it a better scalability solution than the lightning network – which is a bit centralized and has little adoption.

It’s currently at the lowest price it ever got in the last 3 years – reached as low as $96.

As I’m wrapping up this post, BCH is currently at $140.

It has a very little downside from here – maybe at worse, it goes to zero(0).

But at the same time, it got so much upside. I believe the lowest it will reach in the next bull rum is $1500.

Technical Analysis shows a good risk-to-reward trade.

I’m not a huge fan of looking at the trading chart every single day because I’m more of a long-term investor.

However, I check the chart whenever I want to make an entry or exit position into an investment.

Below is the current chart of BCH/USDT. It definitely has a good risk-to-reward ratio.

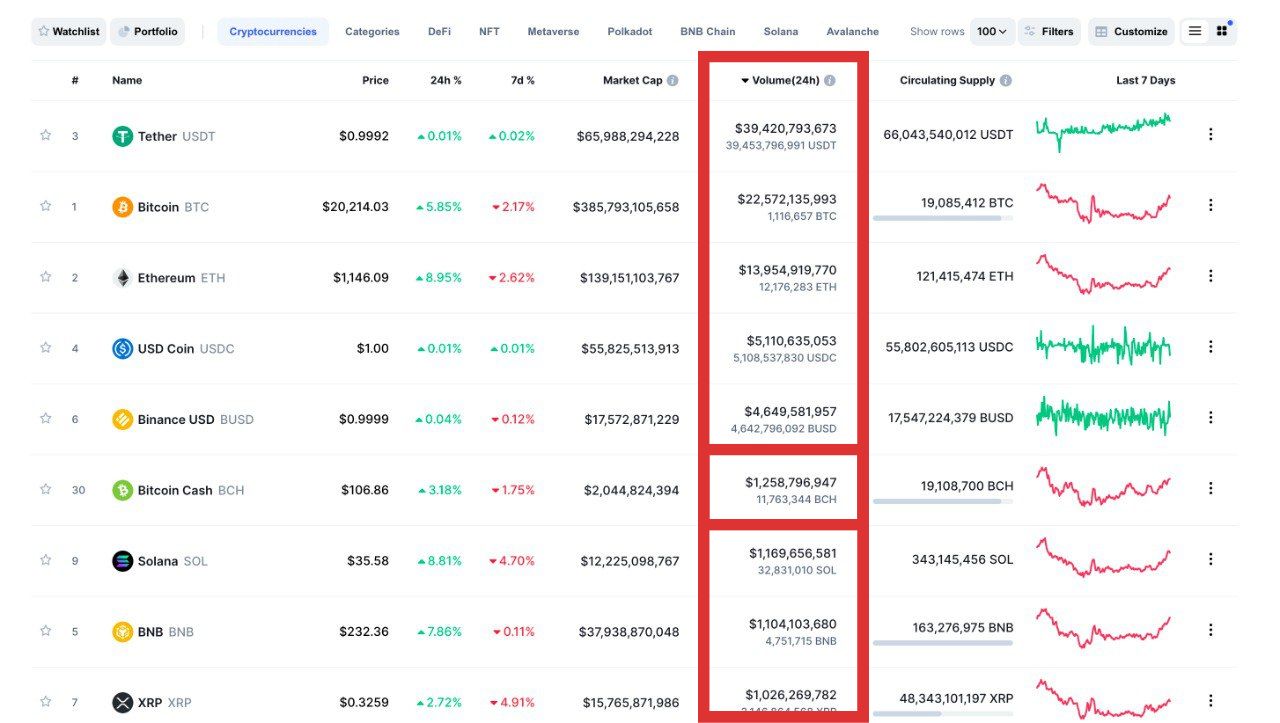

High daily volume

Bitcoin cash has one of the highest daily transaction volumes among major cryptocurrencies.

A huge daily volume shows people are using it.

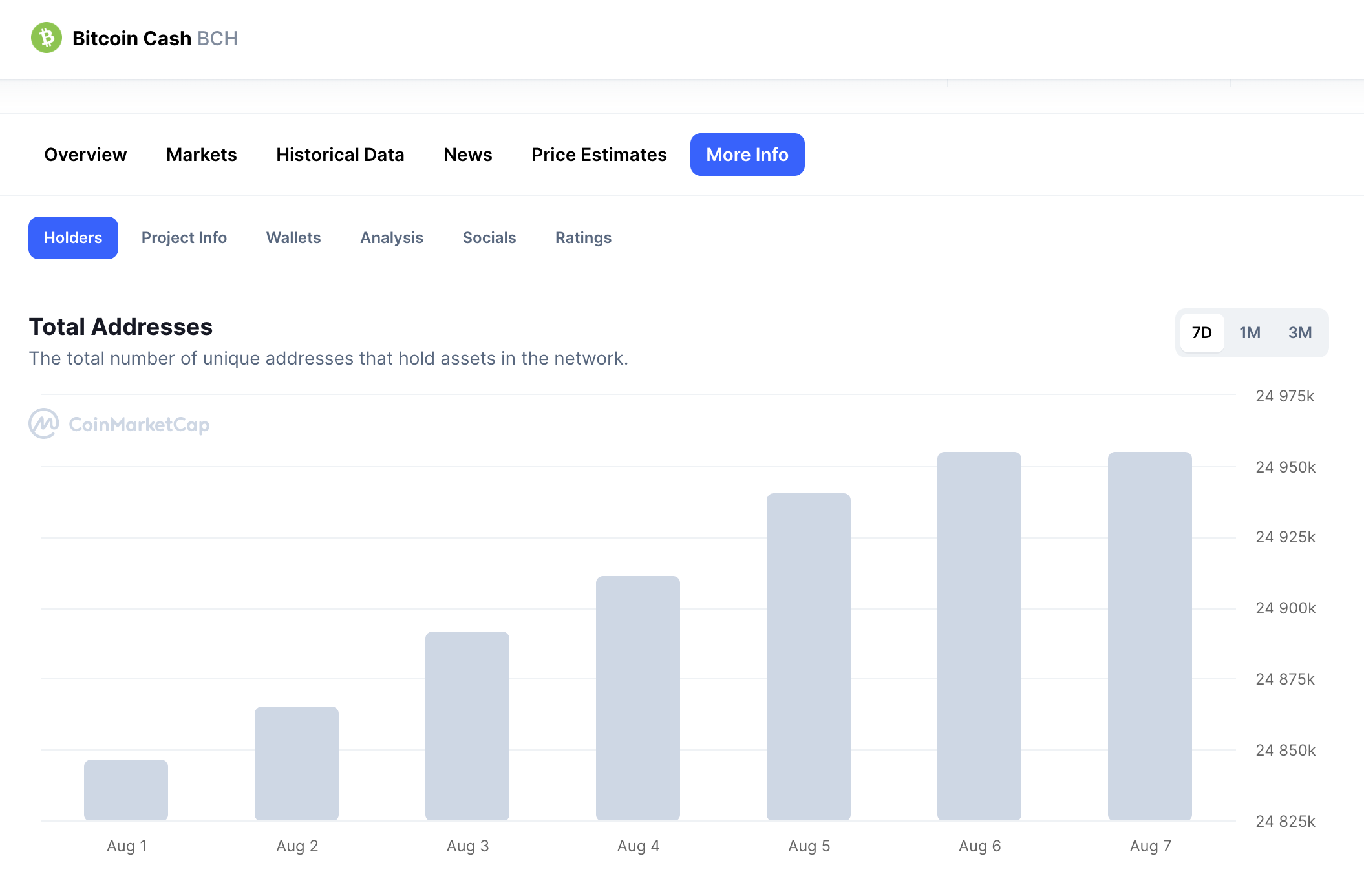

BCH has an increasing number of holding wallets

Since the current bear market started 9 months ago, the current addresses holding Bitcoin cash have been increasing every single day.

It shows more people are taking profit from other coins or assets and putting them into BCH.

BCH has a low market cap

When you compare the market cap of Bitcoin cash with other cryptocurrencies solving global payment, then you will understand that it’s relatively small. Hence, it’s much easier for its price to rise when more money starts pumping in.

Bitcoin cash is accepted globally

Bitcoin cash is currently accepted in over 1000 locations across the globe. Merchants in St Kitts, St Marten, Venezuela, and Nigeria top this list.

Here is a picture of me onboarding the merchants in Ibadan, Nigeria.

Bitcoin cash is sound money

Sound money is any form of money with its supply limited while its adoption and acceptability continue to increase. They have a high stock-to-flow ratio. Which is the ratio of the current stock(circulatory supply) to the inflow of newly minted money.

A good example is gold and Bitcoin. Another good example is Bitcoin Cash.

It recently integrated smartBCH

Smart BCH is an EVM-compatible side chain to the Bitcoin cash network. It brings smart contracts to the BCH blockchain. It also makes DeFi and coin bridging possible.

Conclusion

Enough of my banter/talk. I hope with these few points of mine, I have been able to convince you and not confuse you that BCH is a good investment right now.

I have started buying and keeping it for the long term. You may do the same after doing further research and findings.

Also, I know there are skeptics out there who believe Bitcoin cash is going to Zero. Cain is a good example, and you can read his critics here. Nevertheless, I’m holding onto my BCH and I don’t think this is the best time to sell.

Thank you for taking the time to read through the article.

Feel free to share your thoughts below 👇

To your financial success

Kehinde Lawal