Introduction:

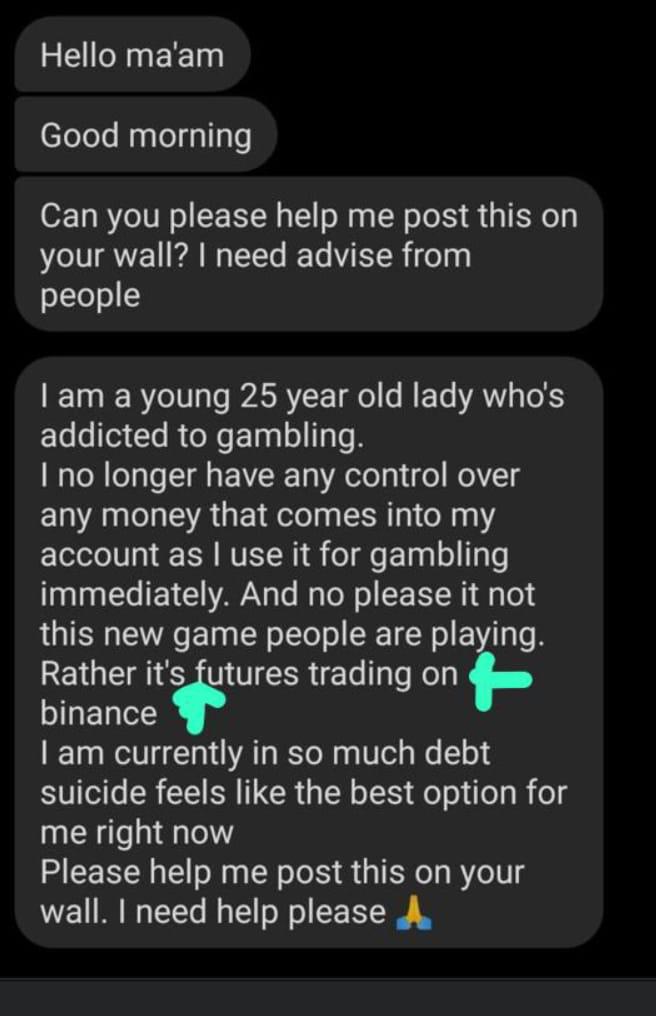

In today’s fast-paced world, technology has opened up numerous avenues for financial transactions and investments. However, with easy access to trading platforms like Binance futures, some individuals find themselves spiraling into addiction. Recently, I came across a WhatsApp message from someone seeking help to break free from their gambling and trading addiction. In response, I shared a comprehensive plan to guide them towards recovery. In this article, we will explore the steps to take to overcome trading and gambling addiction and regain control of one’s life.

Step 1: Uninstall Trading Apps

The first step towards recovery is to remove all triggers and temptations. Encourage the person to uninstall Binance and other exchange apps from their phone. By doing so, they cut off the immediate access to trading, which can be crucial in breaking the cycle of addiction.

Step 2: Take a Break

Breaking free from addiction requires time and patience. Taking a month-long break from any form of trading is essential. This period allows the brain to disconnect some of the addictive neural connections, paving the way for emotional healing and clarity.

Step 3: Rediscover Passionate Activities

Help the individual look back at activities they were once passionate about and encourage them to re-engage with those pursuits. It’s crucial that these activities add value to others as well. This can be anything from volunteering to sharing their skills to help someone in need. Engaging in meaningful activities fosters a sense of purpose and fulfillment, which can counteract the emptiness associated with addiction.

Step 4: Practice with Demo Trading

After the one-month break, suggest they return to trading but only through demo accounts. Demo trading allows individuals to practice without real financial risk, giving them the opportunity to re-familiarize themselves with the market without the pressures of live trading.

Step 5: Implement Proper Risk Management

When the person is ready to resume live trading, emphasize the importance of proper risk management. Encourage them to follow the 1% rule – risking only 1% or less of their total investment capital on each trade. This approach helps protect against significant losses and promotes disciplined trading.

Step 6: Understand Capital Allocation

Educate the individual about the significance of capital allocation. They should allocate only a small portion, around 10% or less, of their investment capital to live trading. Stress the importance of sticking to the 1% position size rule and trading less frequently. Quality over quantity is key.

Step 7: Continuously Educate on Trading Psychology

Emphasize the importance of understanding trading psychology. Suggest they read trading books that focus on this aspect of trading. Learning from the experiences and insights of others can be enlightening and can set them apart from the majority of traders.

Step 8: Seek Accountability and Patience

Recovery is not an easy process, and it requires accountability and patience. Encourage the individual to seek support from friends, family, or a professional. Having someone to hold them accountable can be invaluable on their journey to recovery. Remind them that making up for their losses will take time and effort, but with diligence, they can eventually pay back their debts through work, skills, and responsible trading.

Conclusion:

Addiction to trading and gambling can have severe consequences on an individual’s mental health and financial well-being. Helping someone on the path to recovery requires a supportive and understanding approach. By following these steps and making a conscious effort to change their trading habits, the person can regain control of their life and find a more balanced approach to investing. Remember, seeking help and being patient with oneself are essential components of the journey to overcoming addiction and embracing a healthier financial future.